The put up AirAsia parent firm Capital A releases Q2-2025 financials appeared first on TD (Journey Day by day Media) Travel Daily Media.

Capital A Berhad reported its unaudited monetary outcomes for the second quarter ended thirtieth June on Thursday, twenty eighth August

Contemplating how Q2 is often thought-about a seasonally weak quarter, the Group recorded a income of RM4.8 billion, RM1.1 billion in EBITDA and Internet Working Revenue of RM671 million.

Revenue After Tax (PAT) for the quarter was RM1.5 billion, a considerable turnaround from the RM543 million loss after taxes in Q2-2024, boosted by a RM0.9 billion overseas change achieve.

Highlights from Q2-2025

Aviation income dropped by three p.c year-on-year (YoY) to RM 4.5 billion, largely as a result of weaker tourism and security considerations in Thailand.

Excluding Thailand, income would have elevated by two p.c YoY.

However, EBITDA was up 32 p.c from a 12 months in the past to RM931 million, reaching a 21 p.c margin, pushed by decrease gas costs, stronger Asean currencies and ongoing value optimisation.

Likewise, PAT swung to RM884 million from a RM552 million loss in 2Q2024.

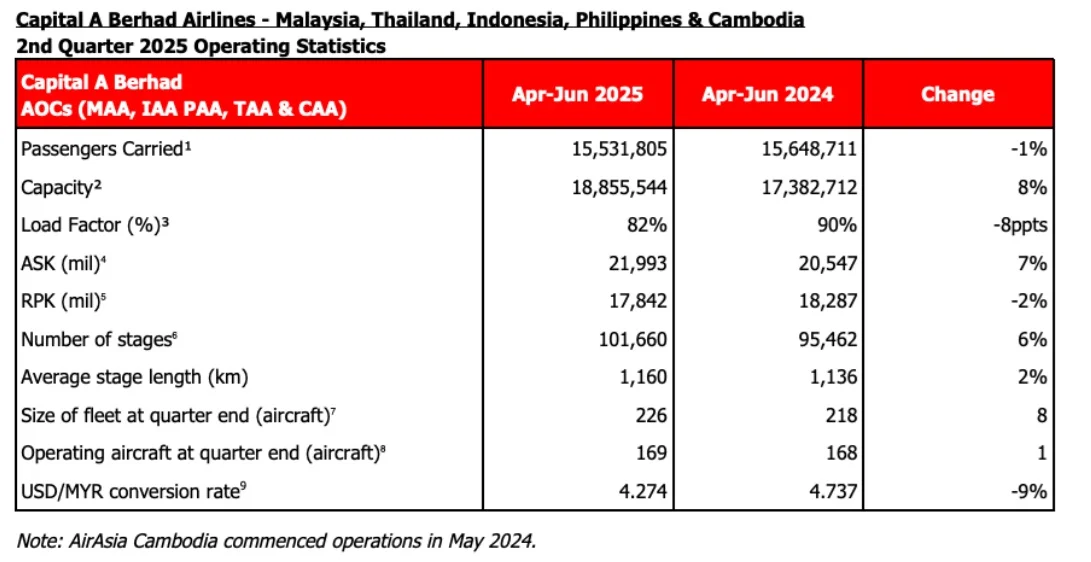

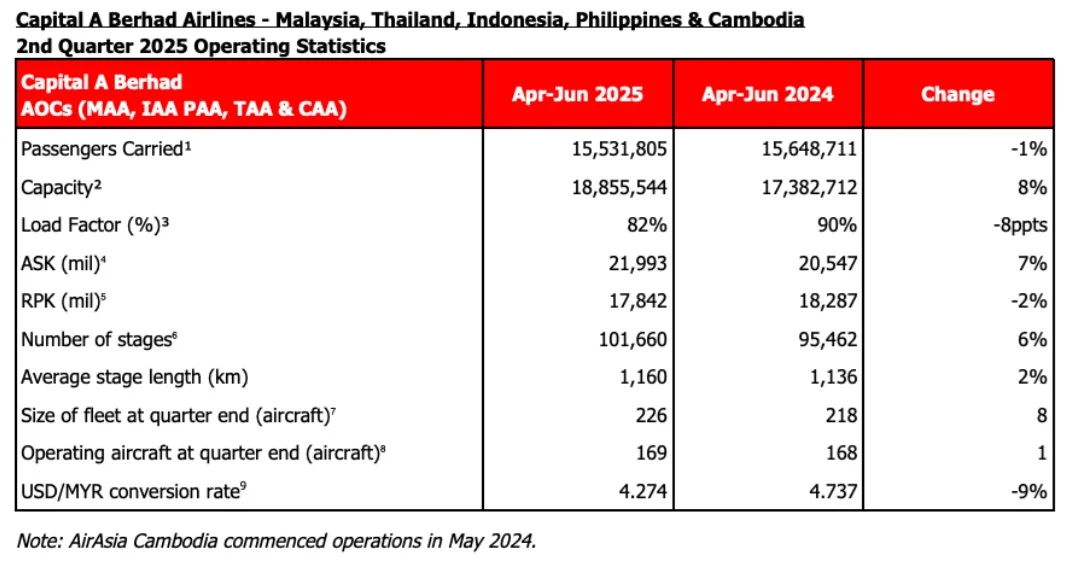

In the meantime, load issue held regular at 82 p.c as capability elevated by eight p.c YoY, whereas the variety of passengers fell marginally by one p.c YoY to fifteen.5 million as a result of softness in Thailand

Likewise, common fare declined by 4 p.c YoY to RM229, largely as a result of Thailand and the change of capability combine to extra home.

Ancillary per passenger improved by two p.c YoY to RM51, whereas ancillary income grew by three p.c YoY, making up 19 p.c of aviation income.

This was pushed by cargo income rising 49 p.c on improved stomach utilisation and higher information personalisation

General CASK fell eight p.c YoY to USc4.50, largely pushed by decrease gas costs and returning to a traditional upkeep profile

General fleet dimension grew by one plane to 226 plane, with 206 energetic plane.

The executives weigh in

Group CEO of AirAsia Aviation Group Bo Lingam remarked that the second quarter demonstrated the resilience of Capital A’s aviation enterprise.

Lingam mentioned: “We offset slower demand in Thailand and decrease fares from returning capability with disciplined value administration and powerful ancillary development, supported by beneficial gas and foreign exchange tendencies. Load issue stays excessive as we carry capability again on-line and align provide with market wants. Core short-haul demand held agency, boosted by the summer season peak in North Asia, regional festivities and lengthy weekends in Malaysia and different key markets.”

He additional expressed confidence that this momentum will carry into the second half, with the fourth quarter traditionally being the airline enterprise’ strongest.

With regard to AirAsia’s Thai market, Lingam mentioned: “Thailand stays an essential marketplace for us, and we intend to carry our market share, particularly domestically, at 40 p.c by means of focused capability redeployment into home and to India, in addition to refined pricing methods. We expect Thailand to see a rebound from the fourth quarter onwards.”

For his half, Capital A chief govt Tony Fernandes lauded the corporate for delivering sturdy leads to what’s often their weakest quarter.

Fernandes enthused: “Aviation’s again on observe, and we’re near returning to our full fleet power. Add to that, nearly all our Capital A Corporations are worthwhile at PAT stage, and we now have sturdy earnings potential. Now that we’ve steadied the ship, it’s all about development.”

The chief govt added that the objective for the subsequent six months is for the corporate to get all its plane again, develop its operations within the Philippines and Indonesia, and return the share of AirAsia on MOVE to 60 p.c with a purpose to develop ancillary income.

At current, the corporate is at the moment engaged on a rated bond and securing native debt to restructure its COVID-era financing which dragged down its earnings.

Fernandes added: “On the aviation disposal, we’re on the final leg of restructuring. In the mean time, we’re within the technique of responding to some suggestions from the Thai SEC, and we hope to resolve any excellent issues quickly.”

The put up AirAsia parent firm Capital A releases Q2-2025 financials appeared first on Travel Daily Media.